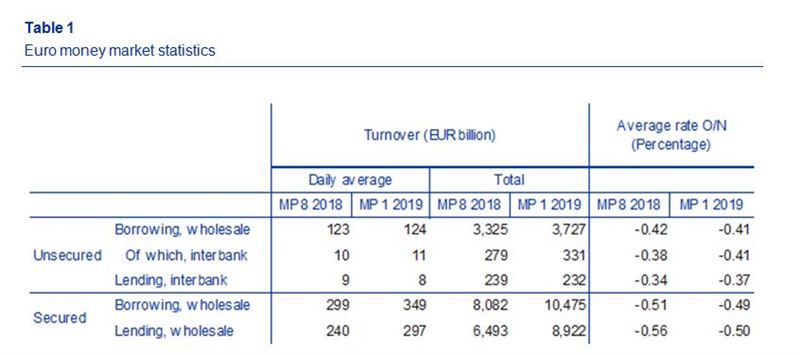

- Daily average borrowing turnover in the unsecured segment slightly increased from €123 billion in the eighth maintenance period of 2018 to €124 billion in the first maintenance period of 2019

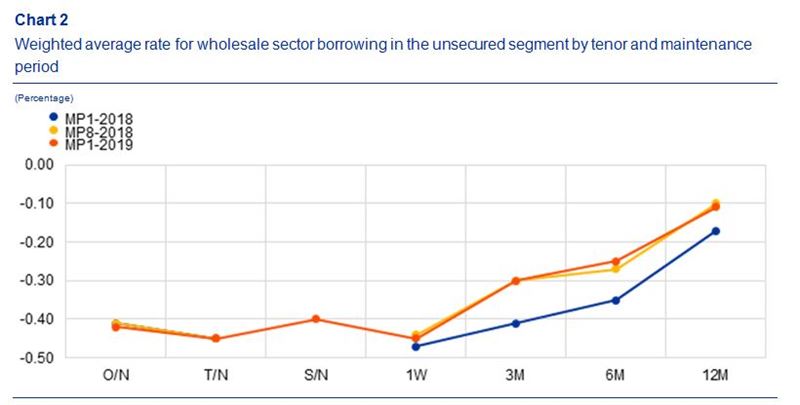

- Weighted average overnight rate on borrowing transactions in the unsecured segment increased from -0.42% to -0.41% for the wholesale sector and decreased from -0.38% to -0.41% for the interbank sector

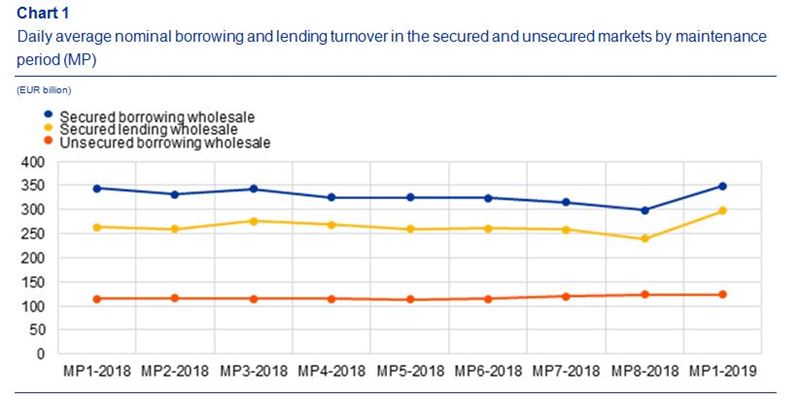

- Daily average borrowing turnover in the secured segment increased from €299 to €349 billion, with a weighted average overnight rate of -0.49%

Unsecured market

In the latest maintenance period, the borrowing turnover in the secured segment averaged €349 billion per day, while the total borrowing turnover for the period as a whole was €10,475 billion. Cash lending represented a turnover of €8,922 billion and the daily average amounted to €297 billion. Most of the turnover was concentrated in tenors ranging from overnight to up to one week, with overnight transactions representing around 21% and 24% of the total nominal amount on the borrowing and lending side respectively. The weighted average overnight rate for borrowing and lending transactions was, respectively, -0.49% and -0.50% for the wholesale sector, compared with -0.51% and -0.56% respectively in the previous maintenance period.

European Central Bank Directorate General Communications

Global Media Relations Division, Sonnemannstrasse 20, 60314 Frankfurt am Main, Germany

Tel.: 49 69 1344 7455, email: media@ecb.europa.eu, website: www.ecb.europa.eu