- Substantial tightening in credit standards for all loan categories

- Loan demand from firms decreased as interest rates continued to rise and financing needs for fixed investment fell

- Demand for housing loans decreased strongly owing to rising interest rates, low consumer confidence and deteriorating housing market prospects

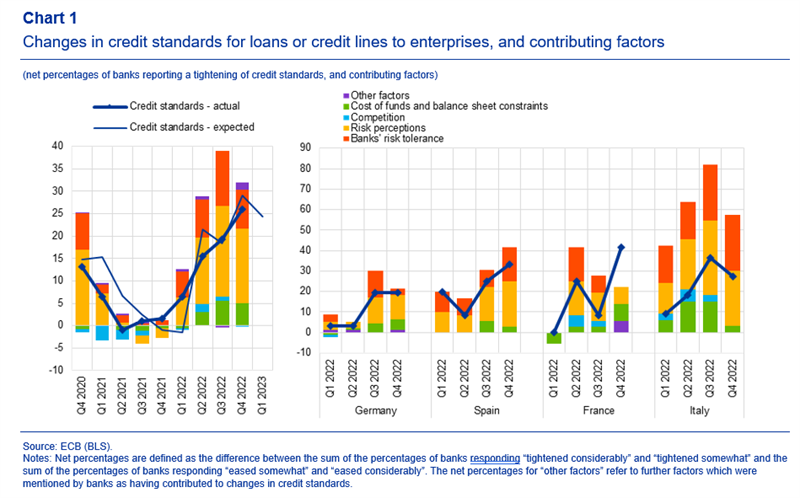

According to the January 2023 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises tightened substantially further (net percentage of banks standing at 26%) in the fourth quarter of 2022 (see Chart 1). Looking at developments from a historical perspective, the net tightening in credit standards was the largest reported since the euro area sovereign debt crisis in 2011. With regard to loans to households for house purchase and consumer credit and other lending to households, banks reported a strong net tightening of credit standards (net percentage of 21% and 17% respectively). Higher risk perceptions related to the economic outlook and industry or firm-specific situation, banks’ declining risk tolerance as well as higher cost of funds continued to have a tightening impact on credit standards for loans to euro area firms. In the first quarter of 2023 euro area banks expect a continued net tightening of credit standards on loans to firms. In addition, euro area banks expect another net tightening of credit standards for both housing loans and consumer credit.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts – tightened for loans to firms and loans to households in the fourth quarter of 2022. For loans to firms, margins on riskier and average loans, collateral requirements and other terms and conditions had a tightening effect. For housing loans and consumer credit, the net tightening of terms and conditions was primarily due to a widening of margins on both average and riskier loans.

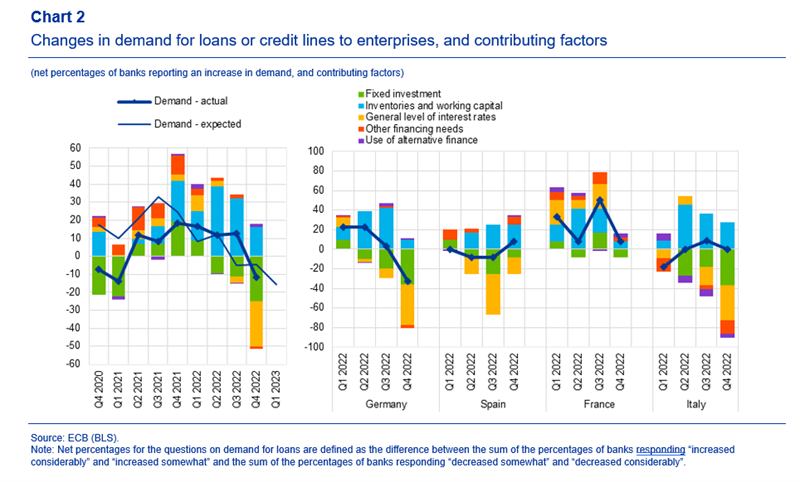

Banks reported a net decrease in demand from firms for loans or drawing of credit lines in the fourth quarter of 2022 (see Chart 2). Banks indicated a significant negative contribution of the rising general level of interest rates to loan demand. In addition, fixed investment had a stronger dampening impact on loan demand. Banks reported a positive impact of inventories and working capital needs on demand for loans to firms, although its contribution was smaller than in the previous two quarters, which likely reflects the gradual easing of supply bottlenecks.

The decrease in net demand for housing loans was the strongest on record, while demand for consumer credit and other lending to households also decreased strongly in net terms, albeit to a lesser extent than for housing loans. The net decrease in housing loan demand was mainly driven by the general level of interest rates, lower consumer confidence and deteriorating housing market prospects. In the first quarter of 2023, banks expect a further net decline in demand for loans to firms. For loans to households, banks expect a continued strong net decline in demand for the first quarter of 2023.

According to the banks surveyed, access to retail funding and securitisation deteriorated moderately in the fourth quarter of 2022, while access to debt securities and money markets improved slightly. Euro area banks reported a strengthening of their capital position in 2022 in response to new regulatory or supervisory requirements, although to a smaller extent than in 2021. At the same time, supervisory or regulatory action had a net tightening impact on banks’ credit standards across all loan categories in 2022. In the second half of 2022, euro area banks’ non-performing loan (NPL) ratios had a broadly neutral impact on credit standards for loans to enterprises and households, while they had a slight tightening impact on terms and conditions for loans to enterprises, and a broadly neutral impact on terms and conditions for loans to households. Euro area banks indicated a more pronounced net tightening of credit standards for new loans to enterprises across the main economic sectors in the second half of 2022. In addition, banks reported a net decrease in the demand for loans or credit lines across all main economic sectors, while for the energy-intensive manufacturing sub-sector there was a small increase in demand.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the January 2023 survey relate to changes observed in the fourth quarter of 2022 and expected changes in the first quarter of 2023, unless otherwise indicated. The January 2023 survey round was conducted between 12 December 2022 and 10 January 2023. A total of 151 banks were surveyed in this round, with a response rate of 99%.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found on the same webpage.

- The euro area and national data series are available on the ECB’s website via the Statistical Data Warehouse. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the BLS, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey“, Occasional Paper Series, No 179, ECB, 2016.

ecb.europa.eu