A milestone in taxation is that the tax office will see all bills from 2021, taxpayers will be helped by a sanction-free period for a smooth transition until March 31, also with regard to the coronavirus epidemic, Norbert Izer, State Secretary for Tax Affairs at the Ministry of Finance, informed MTI.

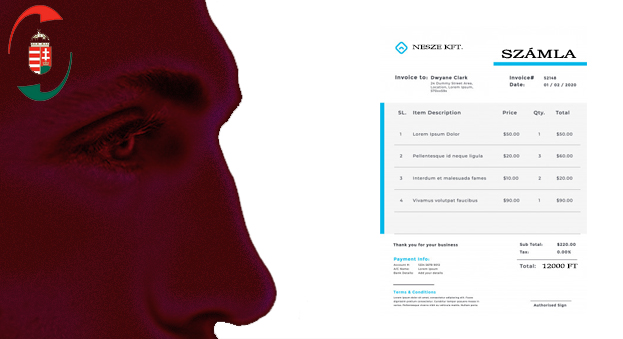

Currently, on average, one million invoices are received by the tax office every weekday. From January 4, 2021, this number could increase to one and a half million a day, because at the legal level, the online invoice system was completed yesterday, with the help of which the National Tax and Customs Administration (NAV) can see all invoices, even those issued to private individuals – Izer Norbert.

The obligation to provide data also covers the supply of goods and exports to other member states of the European Union, so NAV’s risk analysts have a view of practically the entire account turnover of the economic life, he added.

He stressed that preparations had been made more difficult by the coronavirus epidemic, so businesses received tax relief. From 4 January to 31 March 2021, NAV will not impose a default penalty if the Contractor fails to provide, or does not properly provide, data on invoices that have been newly included in the reporting accounts.

Those who have not yet registered in the online invoicing system, because, for example, an invoice has only been issued to private individuals, must register no later than the day the first invoice is issued, as this registration is a condition for non-sanctioning, he explained.

In addition to economic whitening, online invoicing is also an important milestone in the digital transition of businesses, said Norbert Izer. Provisions that allow the online billing service to be provided by issuing an electronic invoice are effective from Monday. According to the amendment to the regulation published last week, the company can also comply with the provision of data by making the electronic invoice available to the customer via NAV in the event of a signal to that effect, the Secretary of State said.

Thus, it is especially worthwhile to switch from paper invoices to electronic invoice issuance – suggested Izer Norbert, adding that according to the calculations of the tax advisors, those affected can save up to seven hundred forints per invoice.

In addition to saving on the cost of issuing, printing, mailing and recording the invoice, a new tax development that will put an end to the age of paper invoices can also help a lot in the fight against the spread of the coronavirus epidemic, the Secretary of State said.

There is still time until the end of the sanction-free period, but in these three months of preparation, accountants and tax advisors will also have a serious task, as the digital transformation will enable tax professionals to guide businesses with their help, said Izer Norbert.

(MTI)